PALLADIUM: A Deep Dive

The first of a series of deep dives into various elements. This post explores Palladium, including 6 key uses, price history, the Palladium to Gold ratio (PaGR), the future of this noble metal & more

Today’s post is going to have in depth look into Palladium, the Palladium to Gold Ratio (PaGR) and why this element is seemingly unloved at the moment. This is the first of many posts featuring different elements. The aim of these deep dives are for them to be informational, educational and easy reading.

Thank you

for your comment on the recent article about the GSR!If you have not yet read the article about the Gold/Silver & Platinum/Gold ratios then please do so using the image below.

The Gold to Silver Ratio (GSR) and how you can possibly take advantage of it

Today’s post is going to have a look at the Gold to Silver Ratio (GSR), Platinum to Gold Ratio (PGR) and also how you could potentially benefit from purchasing the right metals at the right time.

Assuming that silver doesn’t get volatile very quickly and if gold does finish the year above $3,200 (69% chance at the time of writing), then this will still continue to give us a ballpark ratio of somewhere between 1:90 - 1:100, which still makes silver very attractive!

Now onto Palladium!

What is Palladium?

Palladium:

Is a silvery-white looking metal

Is a member of the platinum group metals (PGMs)

Has the atomic number 46

Has the chemical symbol Pd

Was discovered by William Hyde Wollaston in 1803

Is affectionately known as 'platinum’s little brother’

Is exceptionally rare (about 30 times rarer than gold)

Is primarily mined as a byproduct of nickel and platinum

Has a unique ability to absorb hydrogen gas. This makes it a standout element for specific applications.

Is a noble metal i.e. it resists corrosion and oxidation, even at high temperatures.

6 Key uses for Palladium

Palladium has a unique set of chemical and physical properties, thus making it a very good element to use across a wide range of industries. The 6 key uses for Palladium are:

Electronics

Palladium is used in multilayer ceramic capacitors (MLCCs), which are tiny components critical to devices such as smartphones, laptops, and automotive electronics. Palladium also has superb electrical conductivity, which makes it valuable for plating in electronics.

Automobile Industry

Most of the demand for Palladium comes from the automobile industry and especially catalytic converters. Catalytic converters help to reduce harmful emissions by converting them into less toxic substances. For example, turning carbon monoxide into carbon dioxide.

Palladium has superior qualities to Platinum in this regard and therefore is the metal of choice for catalytic converters.

Chemical Industry

Palladium helps to catalyse reactions in the manufacturing of chemicals. Its ability to absorb hydrogen gas means that it can be used in hydrogenation processes that help to produce plastics, synthetic materials and pharmaceuticals.

Hydrogen Technology

Similar to point number 3, Palladium’s ability to absorb hydrogen means that it has a key role to play in hydrogen transport (i.e. the powering of trains/cars etc) and also potentially hydrogen renewable energy.

Dentistry

Palladium can be alloyed with gold or silver to create dental restorations like crowns and bridges. This is because it is strong and highly resistant to corrosion.

Jewellery

Palladium’s natural silvery-white colour makes it instantly popular for jewellery. It is also less dense than Platinum and has at points in time, been cheaper to purchase than Gold & Platinum, thus increasing its desirability as jewellery.

Price History of Palladium?

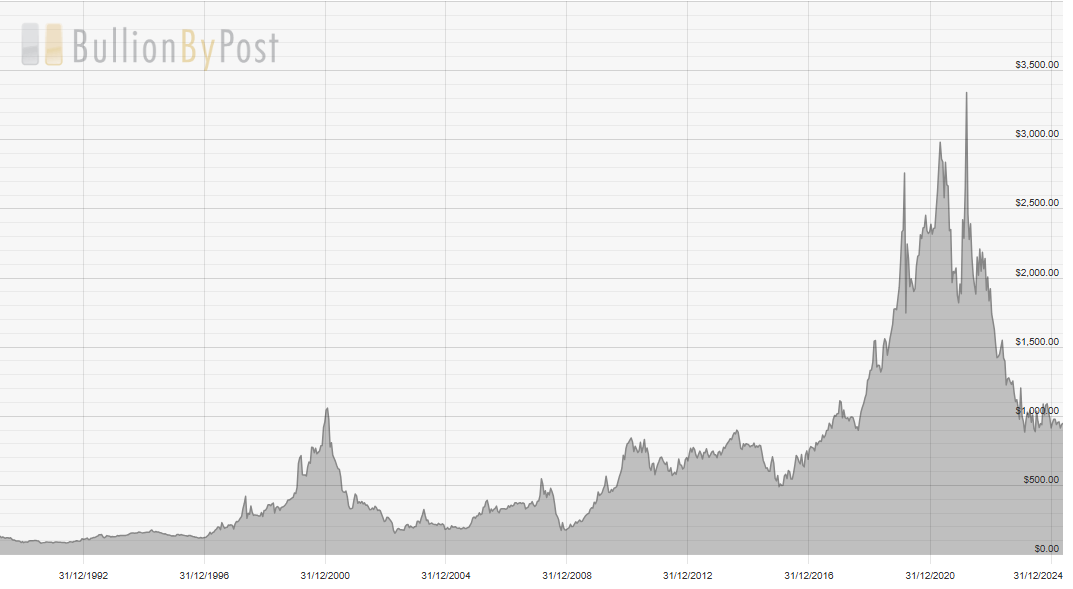

The price charts below (thank you Bullion By Post) say it all. Palladium has been quite wild over the years, fuelled by supply challenges, demand desires and also general market speculation. All prices mentioned in the bullet points below are in USD.

The record low was $41.70 in August 1977. Notably this was before the prominence of catalytic converters

Prices were relatively stable between the 1980s & 1990s ($100 - $150)

Volatility came to be in 2001. Prices rocketed to circa $1,080 in January 2001. This was based on supply fears as Russia delayed exports due to issues within the motherland.

A big dip followed and prices fell back to circa $200. The Global Financial Crisis (GFC) saw prices drop further to $164.

Environmental economics, emissions laws and general sentiment in the 2010s saw Palladium surge back to 2001 levels and then beyond that to $1,500 an ounce in 2019. More supply issues in Russia (and this time South Africa) helped Palladium to rise.

The peak price was circa $3,300 in February 2022 at the start of the recent Russia & Ukraine issues. Sanctions and supply issues meant that the price peak was seen. As those issues were alleviated then prices fell below $1,000 in late 2023.

Platinum became cheaper than Palladium. Platinum is also used in EV’s whereas Palladium is not. This general supply/demand helped to see Palladium drop in price.

At the time of writing, Palladium is circa $945 per ounce.

Palladium to Gold Ratio (PaGR)

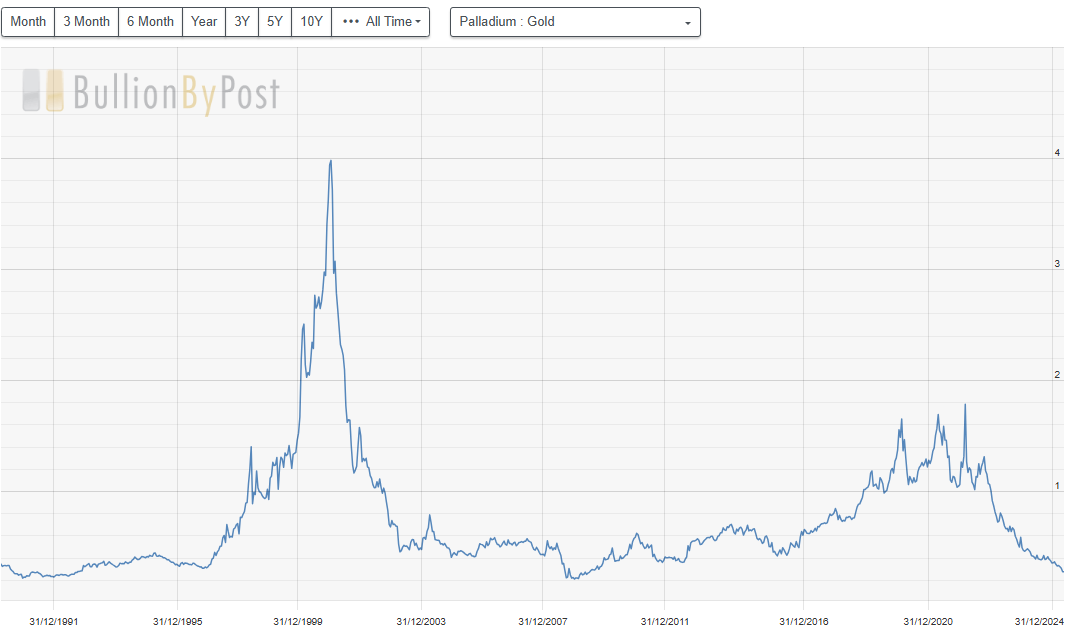

The Palladium-to-Gold Ratio (PaGR) is quite simply the comparison of the price of palladium per troy ounce to the price of gold per troy ounce.

A ratio above 1 means palladium is more expensive than gold.

A ratio below 1 means palladium is cheaper than gold.

NB - the above is as described by ChatGPT

PaGR Summary

Between the 1970s & 1990s, Palladium was far cheaper than gold

In 2001 the ratio hit a high of just under 4 due to a supply shock in Russia

The ratio hovered between 1 - 2 between 2018 - 2022 due to more supply and demand imbalances

Since then, the ratio has gone back down and is now circa 0.27 This is near the overall historical lows and gives credence to the theory that Palladium is relatively historically undervalued at this point in time

Palladium to Gold Ratio

Gold to Palladium ratio

Is Palladium Undervalued?

3 simple arguments for and against.

UNDERVALUED

The ratio is currently quite low

Supply risks (Russia, South Africa, Zimbabwe) could escalate at any point, thus sending prices much higher

Palladium could be short squeezed if sentiment shifts upwards.

NOT UNDERVALUED

Demand weakness because of the rise of EV’s (remember that Palladium is NOT used in EV’s) means that one of the core uses of Palladium is diminishing

A market surplus is predicted in 2025

Strength of gold (and especially given current economic uncertainties) means that gold is reigning supreme at the moment (and will likely do so for the foreseeable future).

Top 5 Palladium producing companies

Below are 5 Palladium producing companies that would be worth keeping an eye out on/doing some more research into. For full disclosure, I have a position in Sibanye-Stillwater. None of these are financial recommendations.

Norilsk Nickel (Nornickel) – Russia

Nornickel is the world's leading palladium producer, accounting for approximately 41% of global production.

Anglo American Platinum – South Africa

In 2023, Anglo American Platinum produced nearly 1.27 million ounces of palladium.

Sibanye-Stillwater – South Africa and the United States

Sibanye-Stillwater is one of the world's largest primary producers of platinum, palladium, and rhodium.

Impala Platinum (Implats) – South Africa

Implats is a major producer of platinum group metals, including palladium

North American Palladium (now part of Impala Canada) – Canada

North American Palladium, acquired by Impala Platinum and now operating as Impala Canada, has been a significant palladium producer

CC’s Conclusion

The current price point for Palladium is somewhat attractive. The PaGR ratio is also quite low. That being said, the biggest use of Palladium is within the automobile industry and, because of generic sentiment end eco concerns, this use is dwindling.

Even though EV’s are hit and miss at the moment, given that Palladium is not used in EV’s then this creates a demand uncertainty. Hydrogen renewable energy is not likely to offset this moving forwards.

More supply shocks are a possibility given global conflicts. The current price point of Platinum also does not help i.e. it makes Platinum more attractive for use in catalytic converters.

If you do not have a position in gold or silver or platinum, then the thesis would be to start positions in those 3 metals (especially silver) first.

If you have physical positions already then you could look to purchase some physical Palladium. This would have to be on a purely speculative basis though.

I am personally not looking to start a position in physical Palladium at present as I find Silver more attractive.

In terms of investing in Palladium mining companies, I already have a position in Sibanye-Stillwater and might look to increase that position moving forwards.

I hope and trust that this deep dive into Palladium helps!

CC

Become a PAID SUBSCRIBER/FOUNDING MEMBER TODAY and get £9,000 of value for just £12 a month!

Contrarian Capitalist PAID Subscribers get:

ALL Market Newsletters (£3,000+ Value) - Weekly Open/Wrap & Monthly Wrap) including charts, analysis & exclusive commentaries

EXCLUSIVE EARLY ACCESS to ALL podcasts (£3,500+ value)

Access to FULL ARCHIVE of ALL posts (£2,500+ value), including commodity deep dives, historical pieces and Layman's articles

Contrarian Capitalist FOUNDING MEMBERS get:

Lifetime membership - pay ONCE and NEVER renews! ALL paid subscriber benefits in a ONE-OFF lifetime payment. I plan on doing this for a LONG time, so this is a spectacular long-term option.

Thank you in advance for becoming a Paid Subscriber/Founding Member.

CC

Really solid piece. One angle that deserves more attention: hybrids and plug-in hybrids are now a major cyclical driver of PGM demand—especially palladium and platinum.

The prevailing narrative has been that EVs are going to kill catalytic converter demand, but hybrids are doing the opposite. Because their engines run cooler and cycle on and off frequently, they need more platinum group metals to meet emissions standards. And plug-in hybrids? Despite their electric-only range, they still need a fully capable emissions system for when the engine kicks in. No shortcuts.

Now with automakers pivoting hard toward hybrids—particularly as a hedge against battery cost volatility and infrastructure gaps—we're likely in the early innings of a stealth demand cycle. The metals everyone thought were on their way out are quietly becoming more critical.

PGM supply constraints plus resurgent demand = a setup that could surprise a lot of people who’ve already moved on.

Great series. Thanks for posting it!