Bonds: Yields, Curves, Inversions and simple examples

This Layman's terms post explores bond yields, bond prices, their relationship, useful diagrams, yield curve + inversions and much more

Today’s post explores bonds. The aim of the post is to deliver a plethora of information about bonds but also to do so in Layman’s terms. It is crucial that we understand how they work and what they signal. Thank you for the continuing feedback with regards to all podcasts/posts.

NB - The diagrams were created by Chat GPT.

What is a bond?

A bond is essentially a loan that you give to a government, company or organisation. In return, they will pay you interest and will return your original amount.

The original amount is considered ‘the principle’ and the end of the bond expiry is called the ‘maturity’.

A bond yield is the return that you earn from holding the bond. As we will see later, that is usually expressed as a percentage.

The two simplest types of yield are:

Coupon Yield

A coupon yield is the interest rates that the bond pays. This is based on the original value of the bond.

I.e. If you buy a bond for £1,000 and it pays £50 a year, then the coupon yield is 5%. This is because £50 / £1,000 = 5%

Current Yield

The current yield is based on the current market price. It is NOT based on the original price.

I.e. The same £1,000 bond is now trading for £900, and it still pays £50 a year. This means that the current yield would be approximately 5.56% (£50 / £900)

3 Key Points

If interest rates in the economy go up, then bond prices will usually fall.

If interest rates in the economy go down, then bond prices will usually rise.

Yields and bond prices move in opposite directions.

Yield to Maturity (YTM)

You can also hold a bond to maturity. You might have heard of this being referred to as Yield to Maturity (YTM).

YTM is the total return that you would earn if you hold the bond until it matures.

This includes all the interest payments that you get over time as well as any gain or loss you might make if you bought the bond at a different price from its face value.

We can say that it is the average yearly return that is achieved overall.

I.e. You buy a bond for £950. That bond pays you £50 per year in interest. After 10 years, you will also get back £1,000.

Therefore, you earn £50 a year in interest + an extra £50 because you bought a £1,000 bond for £950.

YTM is important to understand because it helps you to compare bonds fairly.

It gives you an idea of what you will earn and not just the headline coupon rate.

NB - Bonds don’t take into account the rate of inflation/depreciation of fiat currency

A spanner in the works. What if the yields change?

When you buy a bond, you are promised a fixed interest payment every year. But what if something happens in the economy and the rates change?

Let’s imagine that you have bought a bond that pays 5% interest.

The interest rates rise in the economy and new bonds start being sold that pay 7%.

All of a sudden, your 5% paying bond doesn’t look as attractive as the bond paying 7%.

This means that if you want to sell your bond then you will likely have to lower the price in order to make it more appealing.

A lower bond price will make the bond yield increase. This is because the fixed £ you earn is now better in comparison to the price. i.e. £50 on £900 is better than £50 on £1,000.

In simple terms:

Interest rates rise ➔ Bond prices fall

Interest rates fall ➔ Bond prices rise

Why do yields and price move in opposite directions to each other?

Yields and prices move in opposite directions because:

The payment from the bond is fixed

If the price goes down, then that same fixed payment becomes a higher percentage return relative to the lower price.

If the price goes up, then that same fixed payment becomes a lower percentage return relative to the higher price.

Fixed Payment ÷ Market Price = Yield

When price goes down, yield goes up.

When price goes up, yield goes down.

An example

You have a bond that is paying £50 a year.

That bond is worth £1,000. The yield is therefore 5% (£50 / £1,000 = 5%).

The bonds market price drops to £800. The yield increases as a result. This is because £50 / £800 = 6.25%

Bond Maturity

Short-term bonds normally mature in a few months or a few years

Long-term bonds normally mature in 10, 20 or even 30-year time frames.

Longer-term bonds usually pay higher yields as a reward for you locking up your fiat currency for a longer period of time.

NB - Yields do NOT take into account the cost of inflation or the depreciation rate of your fiat currency.

Yield Curves

A yield curve is a simple graph that shows bond yields across different lengths of maturities i.e. short-term and long-term bond yields on the same chart

Short-term bonds normally have lower yields

Long-term bonds normally have higher yields

This makes the curve upward sloping

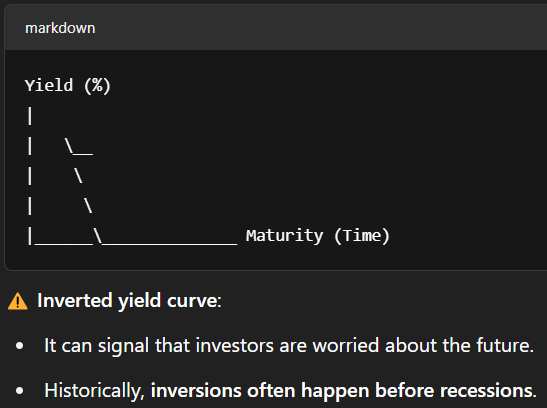

Sometimes a yield curve inversion happens.

This occurs when short-term yields become higher than long-term yields.

Inverted yield curves are normally a warning signal.

Yield curve inversions are important because if people believe that the economy will slow down, then they might want to lock their currency in ‘safer’, long-term bonds.

This means that long-term yields are pushed down whilst the short-term rates stay high.

Historically speaking, an inversion normally indicates that a recession is 6 - 18 months away. This is NOT 100% guaranteed and is viewed more so as a reliable warning.

A summary of a normal yield curve v an inverted yield curve

🔵 Normal curve = A relatively healthy economy with everything in order

🔴 Inverted curve = Markets are worried about slowdown. Recession likely to follow

Hopefully all of this information helps to explain a key component of the economy in both a simple and easy to understand manner.

Become a PAID SUBSCRIBER/FOUNDING MEMBER TODAY and get £9,000 of value for just £12 a month!

Contrarian Capitalist PAID Subscribers get:

ALL Market Newsletters (£3,000+ Value) - Weekly Open/Wrap & Monthly Wrap) including charts, analysis & exclusive commentaries

EXCLUSIVE EARLY ACCESS to ALL podcasts (£3,500+ value)

Access to FULL ARCHIVE of ALL posts (£2,500+ value), including commodity deep dives, historical pieces and Layman's articles

Contrarian Capitalist FOUNDING MEMBERS get:

Lifetime membership - pay ONCE and NEVER renews! ALL paid subscriber benefits in a ONE-OFF lifetime payment. I plan on doing this for a LONG time, so this is a spectacular long-term option.

Thank you in advance for becoming a Paid Subscriber/Founding Member.

CC

If you buy a bond to yield X%, that calculation assumes that all coupon payments are also reinvested at X%, compounding to maturity.