URANIUM: A Deep Dive

Today's post looks in depth at Uranium, including 5 reasons to be bullish, current challenges in the markets, geopolitical factors, pricing structures and more.

In today’s post we will explore all things Uranium, including:

What Uranium is

Main uses of Uranium

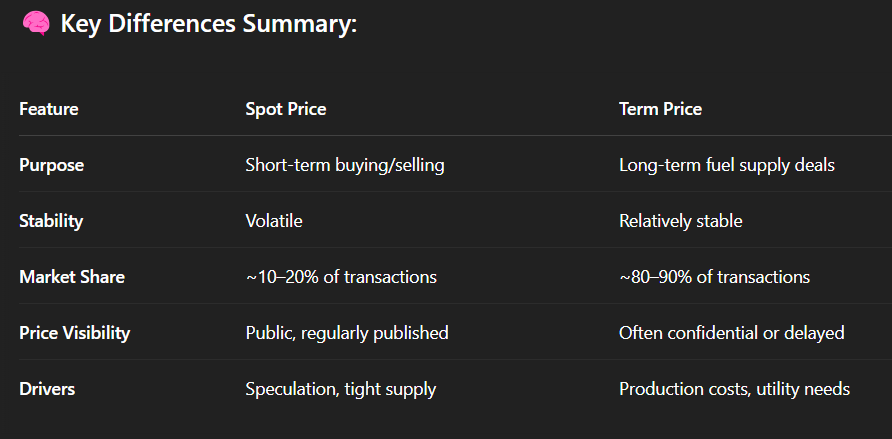

Differences between Spot + Term prices

5 reasons behind the secrecy of Uranium Term price structures

Why more transparency could be beneficial for the markets

5 reasons to be bullish moving forwards

Before we get started it is important to note that Uranium can be used for many good things but also many bad things. We have seen atomic bombs dropped on Japan in 1945 as well as the continuing threat of nuclear bomb use nowadays. Iran looks to be stepping up its nuclear activities in the face of threats from the USA & Israel.

At the time of writing this, thankfully there is a very low chance that Iran is going to enrich Uranium to 90% purity (which is weapons grade Uranium).

I subsequently asked Grok what this meant in simple terms.

Negative connotations of Uranium aside, it can be (and likely will be) used for many great things moving forwards such as nuclear energy and to help create a greener and cleaner plant.

Due to the technicalities and some secrecy involved in the Uranium market, the following is an in-depth conversation with Chat GPT.

I asked Chat GPT to break the information down into bite sized pieces and bullet points. I hope that this helps to make the information both easier to read and more digestible.

Contrarian Capitalist

Before we deep dive into Uranium spot and term prices, let us start with the basics. What exactly is Uranium and, in bullet points, please provide uses of Uranium.

Chat GPT

What is Uranium?

Uranium is a naturally occurring radioactive metal found in the Earth’s crust.

It is silvery-grey in colour and belongs to the actinide series on the periodic table (symbol: U, atomic number: 92).

It’s weakly radioactive in its natural form and occurs mainly as U-238 (~99.3%) and U-235 (~0.7%).

U-235 is the isotope primarily used for nuclear energy due to its ability to sustain a nuclear chain reaction.

Uses of Uranium

Here are the primary and secondary uses of uranium:

✅ Primary Uses

Nuclear Power Generation

Fuel for nuclear reactors to produce electricity.

Most common use worldwide.

Nuclear Weapons

Enriched uranium (especially U-235) used in the cores of nuclear warheads.

🛡️ Defence & Military Applications

Naval Propulsion

Powers nuclear submarines and aircraft carriers.

Uses highly enriched uranium (HEU) for compact, long-duration power.

Armor-Piercing Ammunition

Depleted uranium (DU) used in military shells and tank armour for its high density and ability to penetrate targets.

🧪 Scientific and Industrial Uses

Radiation Shielding

Depleted uranium used to shield equipment and containers from radiation.

Radioisotope Production

Used in reactors to produce medical and industrial isotopes (e.g., molybdenum-99 for cancer diagnostics).

Scientific Research

Used in nuclear physics experiments and materials testing in research reactors.

🏥 Potential Medical Uses (Developing)

Some research is ongoing into using uranium compounds in targeted cancer therapies, though this is not a major use today.

Contrarian Capitalist

Thank you for that explanation. It is clear that Uranium is mainly used for nuclear power generation. Given the way that the world wants to go in terms of clean energy, this is a very good thing.

What is Uranium Spot Price?

And what is Uranium Term Price?

Chat GPT

You're exactly right—uranium's role in clean energy is gaining momentum, especially as countries look to reduce carbon emissions and transition away from fossil fuels. Now let’s break down the two key pricing mechanisms in the uranium market:

🔹 What is Uranium Spot Price?

✅ Definition:

The spot price of uranium refers to the current market price for immediate or near-term delivery of uranium (usually within 30 days).

Measured in U.S. dollars per pound of U₃O₈ (Triuranium octoxide, the standard traded form).

📌 Key Points:

Reflects short-term market sentiment.

Volatile and influenced by:

Supply disruptions

Geopolitical tensions

Utility buying surges

Financial speculators (e.g., uranium holding funds)

Only about 10–20% of uranium transactions happen on the spot market.

Think of it like the "stock price" of uranium—changing daily or weekly based on demand/supply signals.

🔹 What is Uranium Term Price (also called Long-Term Price)?

✅ Definition:

The term price is the price agreed upon in long-term contracts (usually 3 to 10+ years) between uranium producers and consumers (mostly nuclear utilities).

📌 Key Points:

Much more stable than the spot price.

Often negotiated confidentially, based on forecasts, cost of production, inflation, and risk management.

Makes up 80–90% of all uranium trading.

Contracts often include:

Base price + escalation clauses (tied to inflation or fuel indices)

Flexibility in delivery volumes and timing

Contrarian Capitalist

Why is there so much secrecy with regards to the term price?

Chat GPT

Great question—and it gets to the heart of how the uranium market is very different from more transparent commodity markets like oil or gold.

🤫 Why Is There So Much Secrecy Around Uranium Term Prices?

Keep reading with a 7-day free trial

Subscribe to The Contrarian Capitalist to keep reading this post and get 7 days of free access to the full post archives.