Weekly Open - 28/04/2025 - Who will be the new Canadian PM? Will the markets continue to rebound?

Plus a look at VIX, DXY, Bond Yields, good news for HYG and the possible direction of the markets moving forwards

As usual, my apologies if any data and/or information has changed as a result of Asian/early European trading.

Canadian Elections

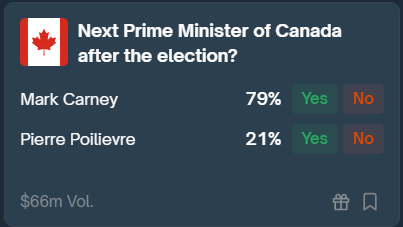

The Canadian Federal election takes place on Monday 28th April 2025. Being from the UK and experiencing how Mark Carney led the Bank of England and what carnage was caused there, all I can do is wish Canadians the best of luck if the polls are right.

With a current 79% chance of being the next Prime Minister of Canada, Mark Carney will likely take Canada (and Canadians) back a few steps! I’m hoping to have a chat with Kris Sims about Canada in the month of May. It’s not just about who is in charge but the policies in which they will bring with them!

Podcast + Posts

We will hopefully be recording with

and this week for The Contrarian Capitalist podcast. We will deep dive into charts and analysis with and the chat with will be a wide ranging conversation as it was last time.If you have not yet listened to the previous chat with John, then you can do so below.

John Carter - Peaceful paths to remigration and the chilled years ahead

In this eye opening conversation, John Carter of Postcards From Barsoom gives insightful thoughts on the potential peaceful ways for remigration and also how the UK is on the path to becoming a land for one party politics.

There will also be a deep dive into Uranium and Platinum this week ahead!

If you are yet to subscribe to

then please do so using the button below.European + Asian Markets

We saw in the Weekly Wrap that the US Indices rebounded nicely last week. In Europe, the DAX + FTSE also finished the week on green candles. It was a similar story too in Asia in the Hang Seng (Hong Kong) and Nikkei (Japan).

It means that most of these indices are now just underneath the levels they are approximately 3 weeks ago.

Nikkei = UP 4.32%

Hang Seng = UP 3.62%

DAX = UP 5.42%

FTSE 100 = UP 2.12%

Nikkei (Japan)

Hang Seng (Hong Kong)

DAX (Germany)

FTSE 100

The markets appear to be in some form of recovery mode at the moment. Giant waves of currency printing will very likely have to happen in due course. In turn, this will fuel the blow off top that I’ve been mentioning about for a while.

Until then, the best thing that could happen is to get some (relative) calmness in the markets. Less uncertainty is going to be better for the major indices across the board.

NB - It is Labour Day for many parts of the world on Thursday 1st May 2025, so you might find market activity that day a little less busy than usual!

Lets move onto Treasury Yields, DXY, VIX and HYG.

US 10 Year Treasury Yield

This is the main thing that the Federal Reserve will be watching! The US 10 Year Treasury Yield finished the week on 4.26%. This is much higher than Trump and team would like but it is now also moving in the right direction, which coincides with the White House seemingly ‘cooling off’ (and I use that term very loosely) on a number of matters at present.

Keep reading with a 7-day free trial

Subscribe to The Contrarian Capitalist to keep reading this post and get 7 days of free access to the full post archives.