Weekly Wrap 06/06/2025 - Silver & Platinum up over 9%. Trump v Musk blows up. Epstein files anyone?

Full chart deck, 5 key takeaways from the week and more. Get the popcorn ready because things will likely unravel at an explosive nature moving forwards!

Welcome to the Weekly Wrap. We will start with a quick recap of the new referral programme that is now in place.

New Referral Programme

Refer 1 friend, then you will automatically receive a FREE 14-PAGE GUIDE TO GOLD + SILVER INVESTING.

Refer 3 friends and get 1-month complementary subscription.

Refer 5 friends and get 3-month complementary subscription.

If you had already referred a friend(s) then you should have automatically received the referral awards. If there are any issues, then please do DM me and apologies in advance if there are teething issues as a result of Substack.

Summary of the markets this week

Gold = UP $34.15 (1.04%)

Silver = UP $3.02 (9.16%)

Platinum = UP $105.20 (9.97%)

Palladium = UP $77.53 (7.99%)

Uranium U308 Futures = DOWN -$1.30 (1.81%)

Brent Crude = UP $3.78 (6.05%)

Dow Jones = UP 443.13 points (1.05%)

Nasdaq = UP 214.35 points (0.03%)

S & P 500 = UP 61.08 points (1.03%)

Trump v Musk

There are so many other people out there that are doing a tweet-by-tweet commentary of what Musk says, what Trump says, what Musk says in reply and so forth. I’m not going to put you through the pain of that but will summarise succinctly.

Musk is likely very p*ssed off that his efforts with DOGE, the uncovering of a lot of government inefficiencies and trying to make a change to the way that the public views government spending have all been undone by this Big Beautfiul Bill.

Ultimately, politics is politics and Trump (and team) probably realise that adding a few trillion to the public debt is what they have to do in order to keep the American economy humming. It is also good for approval ratings, and they will have the mid-terms in mind. Keep the house and senate in 2026 and they have a clear path to 2028.

PS - Just get rid of the mid-terms and the USA won’t have to think in 2-year blocks of time

This has led to a major fallout where they are now having a sparring match online.

Both men have big egos. Both men are likely very p*ssed off with the other.

Is Trump really in the Epstein files?

What else will they say? What else will happen?

Who knows but it will certainly be entertaining and it highlights 2 key things:

Fiscal policy will not change. Adding a few trillion to the current deficit will increase spending. This will mean the printing presses have to go back on and all of this will ultimately be great for gold and silver.

Fragility in the American economy and it is possible that some dark secrets will get shown

Could all of this could be staged? That’s just my contrarian whiskers getting excited!

All of this though does symbolise that there could be (and likely will be) a massive power struggle before our eyes in the coming weeks/months. This goes hand in hand with point 2 above.

Podcasts & Posts

This week’s written post looked at 4 reasons the Yen Carry Trade could blow up - In Layman's Terms!

4 reasons the Yen Carry Trade could blow up - In Layman's Terms

This post will look at a carry trade and, specifically, the Yen Carry Trade.

There was also a video that looked at 5 reasons Silver ‘should’ surge. Pretty apt that this came out just the day before silver decided to test $36!

5 reasons Silver ‘should’ surge + Plan B (it is not too late to get one)

Articles to read & podcasts to listen to

3 podcasts were recorded. They were with

(small cap value investing), (environment, energy, politics) and Kai Hoffmann (Silver, mining, Germany & EU).Shailesh Kumar - 1 key attribute you NEED when it comes to investing

Today’s podcast guest is Shailesh Kumar, MBA of The Astute Investor's Calculus. Shailer is a former management consultant and an entrepreneur with multiple exits.

Roger Pielke Jr - The global energy challenge is much bigger than most people realise

Today’s guest is Roger Pielke Jr., a political scientist and professor at the University of Colorado Boulder, where he explores the intersection of science, policy, and decision-making.

Kai Hoffmann - The 3 opportunities of the coming financial conundrum

Today’s podcast guest is Kai Hoffmann. Kai is a prominent figure in the junior mining and resource investment sector, with a multifaceted career spanning media, finance, and corporate leadership.

ALL podcasts are released to PAID SUBSCRIBERS first. To gain early access to all podcasts before the general public (and other benefits too) then please consider becoming a paid subscriber by using the button below.

SILVER

The only place to start this week is Silver. I wrote last week that ‘Silver continues to frustrate and disappoint a LOT of people. Mr Slammy continues to show up (and will continue to do so) and it is more than likely that silver will majorly surprise to the upside when it is least expected!’

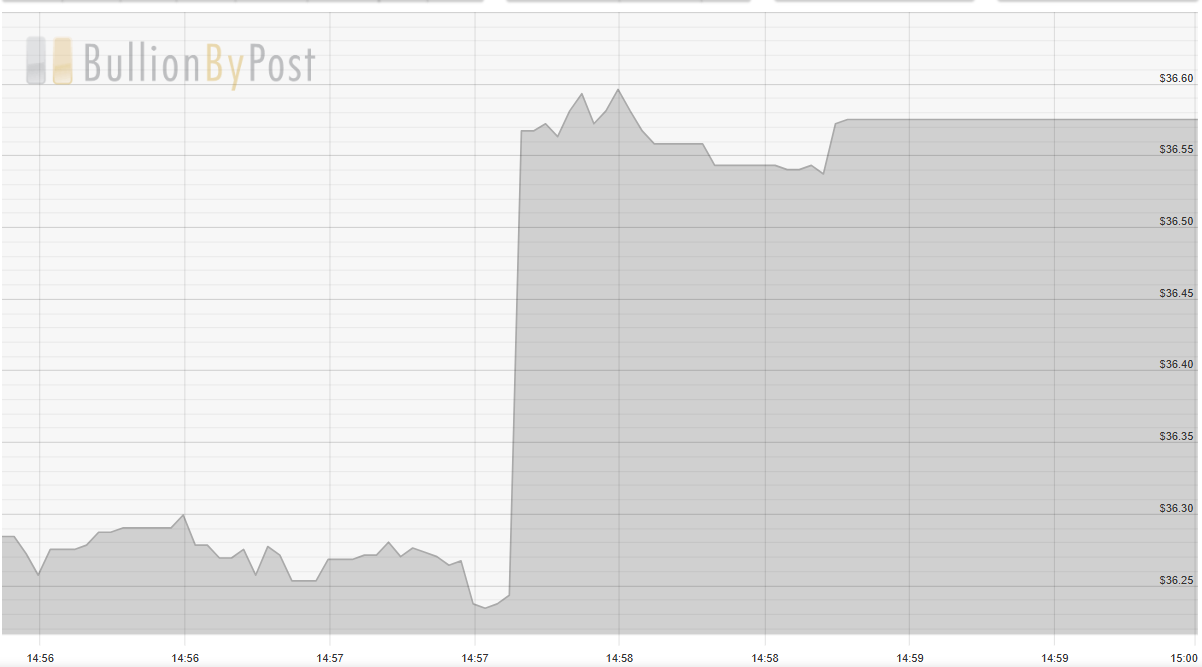

Well, it topped $36 on Thursday 5th June (a rare event), touched it again throughout the day on Friday 6th June and ultimately finished Eastern Time trading (16:00) at just over $36. A BIG move came just before 17:00 ET as silver shot up to finish the week at $36.57.

Even Mr Slammy did not bother turning up on Friday.

This does not mean that it is a case of onwards and upwards in the short to medium term. RSI is high and silver is showing that it is extremely overbought.

That being said, the fear of missing out (FOMO) might be enough to send it even higher! A true silver squeeze could be in play here!

It is encouraging signs for silver and the long term is still incredibly bullish due to a number of both industrial and retail demand factors. Next week will see a 2-part series (available to all subscribers) with

. I answer a set of questions about silver, solar, energy and more.GOLD

Gold finished the week UP $34.15 (1.04%)

Gold is showing strong signs of consolidation. This is a classic bull market indicator. Recent small pullbacks have likely been due to profit taking. Bond Yields remain high and this uncertainty in the markets will continue to drive people towards gold.

Daily and Weekly charts below

Now onto Platinum, Palladium, the various ratios, Copper (a good week), Brent Crude and more….

Keep reading with a 7-day free trial

Subscribe to The Contrarian Capitalist to keep reading this post and get 7 days of free access to the full post archives.