Weekly Wrap - 14th Mar - Gold tops $3,000, Silver $34 as US indices attempt a turnaround....

Markets look a little bit better over in Europe & copper continues to strengthen

Welcome to the Weekly Wrap!

The big headline from the week is that Gold topped $3,000 USD (on both futures and spot). This is a very good psychological milestone and one that should be celebrated.

For anyone in the UK and looking at Gold in £’s - then today did not see an ATH in £’s as this was achieved back on 11th February 2025.

Silver briefly topped $34 and the US indices finally showed a bit of life on Friday 14th March, stopping a 2 to 2.5 week slump.

Before we get into the summary and charts, just a quick note to say that I made an appearance on The Contrarian Pod with

yesterday. It was a pleasure to be featured on the show and do go and check it out by clicking on their name in the previous sentence.Summary of the markets this week

S&P 500 = DOWN circa 2.48%

Dow Jones = DOWN circa 3.24%

NASDAQ = DOWN circa 2.64%

Gold = UP circa 2.6% this week + tops $3,000 intraday

Silver = UP circa 3.8%

Nat Gas = DOWN circa 6.5%

Brent Crude = UP circa 0.1% and avoids 8 straight weeks of losses

GOLD

In my 6 x predictions for 2025, I predicted that Gold would hit $3,000 USD. It was pleasing to see this happen, albeit in intraday trading. The next step would be a decisive close above $3,000 USD in the spot market.

When Gold ultimately hits 5 figures then this will be good for gold bugs but probably means that things have gone seriously wrong in the world!

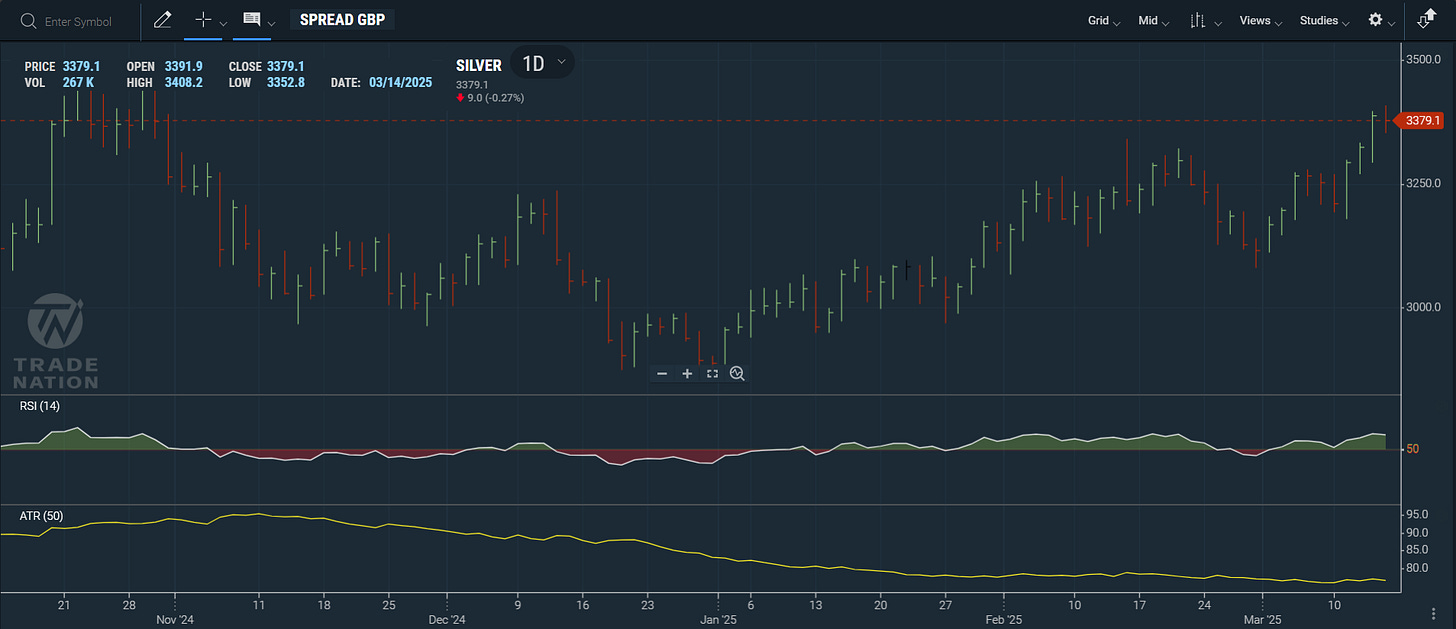

SILVER

Spot Silver topped $34 before turning ever so slightly down on Friday. Mr Slammy strikes again! The long-term picture for the precious metals have not changed (and will not change for a considerable amount of time).

Copper also looks like it is surging forwards and the US Indices appear to be trying to rebound…….

Keep reading with a 7-day free trial

Subscribe to The Contrarian Capitalist to keep reading this post and get 7 days of free access to the full post archives.