PLATINUM: A Deep Dive (Updated with recent charts and information)

Including 4 Contrarian Investment Ideas, 4 main uses, 3 reasons to be bullish, PGR/GPR ratios, supply & demand issues, Platinum v Palladium, top 5 platinum producing companies and 25% off for life

NB 1 - This post is an updated version of Platinum: A Deep Dive. A lot has happened since the original post was posted and this post includes information and charts as of Thursday 19th June 2025 AM Mexico time.

If you would like to read the original post then you can do so here.

Other deep dives have included Palladium and Uranium.

You can read about Palladium here.

You can read about Uranium here.

NB 2 - CC surpassed 2,500 subscribers this week. As a thank you, I would like to offer you 25% off for life on both monthly and annual subscriptions. Please use the button at the bottom of the article. Offer valid until Tuesday 24th June 2025.

What is Platinum?

Platinum:

Is a rare, dense, silvery-white precious metal

Is a member of the platinum group metals (PGMs)

Has the atomic number 78

Has a very high melting point of 1,768 °C

Is much rarer than Gold or Silver

Is very malleable, making it easy to work with

Is corrosion resistant

Roughly 30x rarer than gold and is mined in only a few regions around the world

Approximately only 180 tonnes of Platinum are mined per year

4 Main uses of Platinum are:

Industry

The current biggest use of Platinum is for catalytic converters. Catalytic converters help to reduce harmful emissions by converting them into less toxic substances. For example, turning carbon monoxide into carbon dioxide.

Platinum is also widely used in the green hydrogen economy as it is used as a catalyst for electrolysers. Platinum is a critical catalyst in hydrogen fuel cells, especially Polymer Electrolyte Membrane fuel cells (PEMs), which are used for clean transportation.

It can also be used in both petroleum refining and glass manufacturing.

Investment

As mentioned in the GSR article, Platinum can potentially be a very good investment for those not wanting to purchase gold. You can probably buy physical platinum from a number of coin dealers. These will likely be in the form of both coins and ingots.

It is not traded or purchased as regularly as gold or silver. Please always do your own homework and research before making your investment decisions.

Medical Applications

Platinum is a biocompatible metal, meaning that it does not react in the body. That is NOT an excuse to eat any physical platinum that you might have sat around by the way!

Because of its biocompatibility, it can be used for implants, pacemakers and even cancer drugs.

Jewellery

Platinum is a very popular form of jewellery use in Asia. Its rarity and shine makes it very attractive to wear. Its durability is also a contributing factor for its jewellery use.

Platinum Supply + Demand structures

Supply

Platinum is extremely rare and makes up less than 0.003% of the Earth’s crust.

The 4 main countries that supply Platinum are:

South Africa (approx. 70% of the world’s supply)

Russia (approx. 10% of the world’s supply & - mainly via the Norilsk Nickel mines

Zimbabwe

Canada

Other countries such as Australia and USA do produce Platinum but not as much as the above 4 countries.

Supply Challenges

The rarity of Platinum and the usual depth of it (it is normally found approximately 2,000m BELOW ground level) means that it is not the most cost-effective mineral to mine.

It’s current price of circa $1,275 (£950) is also a current contributing factor (although that price has improved considerably since the original article was published back in April 2025).

Political risks are always in play. The biggest producer in the world is South Africa. Unfortunately, SA has been plagued with issues recently and they show no signs of abating.

3 key risks coming from South Africa are:

Load-shedding (energy crises)

Labour strikes

Aging infrastructure and lack of investment moving forwards

1 key risk coming from Russia is countries stupidly sanctioning against Russia - and thus denying themselves the opportunity to acquire said Platinum from Russia.

A decline in Platinum rich ore grades mean that Platinum will become more expensive to mine moving forwards. This could be offset by higher Platinum prices.

The oil price is also worth watching out for. A much lower oil price (combined with an increase in Platinum prices) could mean an increase in margin, which would be beneficial for Platinum producers.

Demand

Demand is covered in depth by the ‘4 main uses’ section above.

Industry (The automobile industry counts for 40% - 45% of global demand)

Jewellery accounts for approximately 30% of global demand)

Investment demand

Medical applications

Supply/Demand Imbalances

Overall, the declining supply of an already rare element combined with the rising industrial demand means that there could be a sustained industrial imbalance moving forwards. The key difference between Palladium and Platinum is that Platinum CAN be used in electric vehicles.

Given the way in which the world is going in terms of ‘green energy’, it seems likely that demand is going to be more or less sustainable. That combined with a very small Platinum market - and not to mention energy - paves the way for potentially much higher Platinum prices moving forwards.

Recent podcast guest Clem Chambers explained Platinum and Energy in great detail.

Clem Chambers - 3 Key Drivers of Bitcoin & 1 key driver of Platinum

Today’s podcast guest is Clem Chambers.

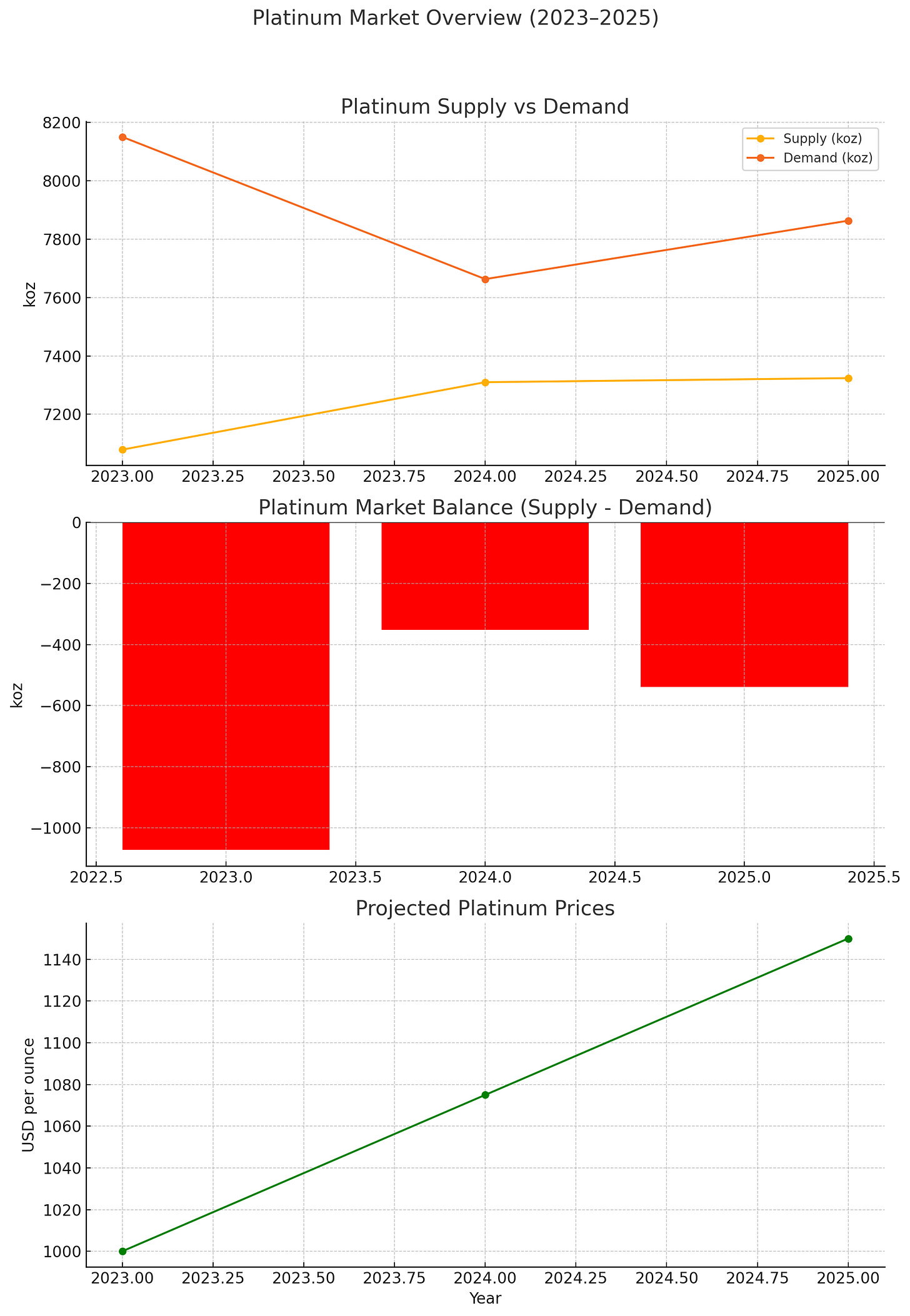

Back to supply and demand imbalances, I asked Chat GPT to create a couple of graphics representing them. Here is what Chat GPT came up with.

Projected Platinum Supply and Demand through to 2030

Pricing Challenges

Platinum pricing can be prone to more volatility than gold or silver due to the scarcity of it and also because of the main jurisdictions in which it is mined i.e. South Africa and Russia.

Platinum has a lower market liquidity than gold and silver and, similar to silver, is more sensitive to industrial changes.

The weakening of the US Dollar will also likely have an impact on the price moving forwards.

Current Price + PGR/GPR

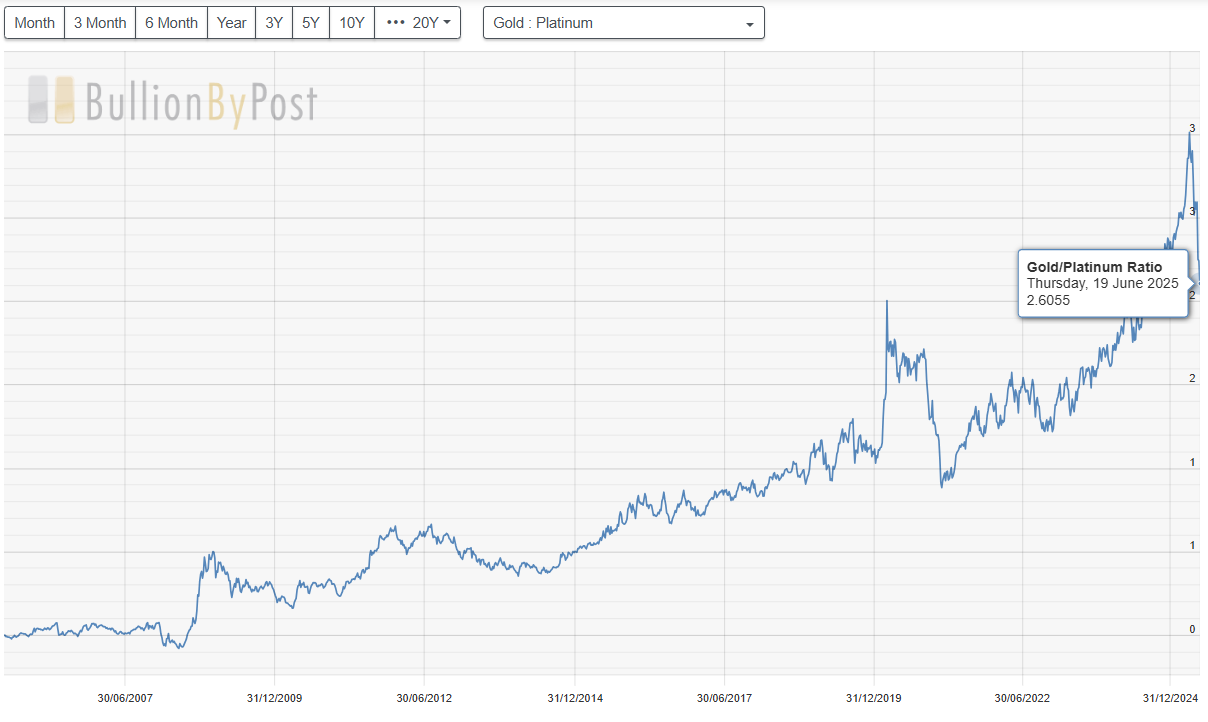

Thank you to Bullion by Post for the charts and please note that these prices/ratios were correct at the time of re-editing this article on Thursday 19th June 2025.

The current price (in USD) for an ounce of Platinum is approximately $1,275. The charts below show the last 3 months, last year and last 20-year price charts in USD.

In USD terms, Platinum has increased by approximately 28% in 3 months.

In GBP terms, Platinum has increased by approximately 24% in 3 months.

In EUR terms, Platinum has increased by approximately 22% in 3 months.

This also shows us which of the currencies is getting weaker quicker.

The current Platinum to Gold ratio sits at 0.3838 (1 year and 20-year charts below). You can see the massive difference in the 20 year chart. Back in 2008 the PGR was around 2.1, meaning that you could buy 2.1 ounces of gold for 1 ounce of Platinum.

That now sits at 0.3838, a significant difference.

Inversely, the Gold to Platinum ratio sits at 2.6055 (1 year and 20-year charts below)

There is a potential arbitrage opportunity by buying physical Platinum and then selling that for Gold when the PGR increases. NB - NOT INVESTMENT ADVICE

3 reasons why Platinum could be attractive as an investment

As the world moves toward clean energy, Platinum has a clear role to play in hydrogen fuel. Even if that fails, then it still has a use in catalytic converters

Supply-demand imbalance (as mentioned above)

Platinum is priced much lower than gold and is rarer

NB - Not investment advice

Platinum v Palladium

As discussed last week, Palladium has often been priced higher than platinum due to its scarcity and role in the automobile industry. As Platinum demand grows due to the likely expansion of the hydrogen industry, this will have an impact on the price premium that palladium has traditionally had over Platinum.

Palladium is pretty much solely tied to the car industry. Platinum has a more diversified role in the world.

In the piece on Palladium, I wrote:

If you do not have a position in gold or silver or platinum, then the thesis would be to start positions in those 3 metals (especially silver) first.

If you have physical positions already then you could look to purchase some physical Palladium. This would have to be on a purely speculative basis though.

I am personally not looking to start a position in Palladium at present as I find Silver more attractive.

My thesis is that if you are looking to invest into physical metals, then look at Silver first, then Gold and then Platinum.

Top 5 Platinum producing companies in the world

I asked Grok to compile a list of the 5 Platinum producing companies in the world, based on the latest available data and by per metric tonne. For full disclosure, I have a position in Sibanye-Stillwater and due to the nature of Palladium and Platinum, you might find that these companies are very similar!

1 - Anglo American Platinum (Amplats) - South Africa

Production (2023): ~54.43 metric tonnes (1.75 million ounces)

Based in Johannesburg, South Africa, Amplats is the world’s largest platinum producer, operating 11 mines in South Africa and Zimbabwe. It accounted for ~38% of global platinum supply in recent years. Major operations include the Mogalakwena and Amandelbult mines in the Bushveld Complex.

2 - Impala Platinum Holdings (Implats)

Estimated 2023: ~35–40 metric tonnes (based on market share and South Africa’s 120,000 kg output)

Also HQ’d in Johannesburg, Implats operates in South Africa (Impala Rustenburg, Marula) and Zimbabwe (Zimplats, Mimosa). It’s the second-largest platinum producer, with significant operations in the Bushveld Complex and Great Dyke.

3 - Sibanye-Stillwater

Estimated 2023: ~25–30 metric tonnes (based on South Africa and U.S. contributions)

Johannesburg-based, with major platinum operations in South Africa (Marikana, Rustenburg) and the U.S. (Stillwater, East Boulder mines in Montana). Acquired Aquarius Platinum (2016) and Lonmin (2019), enhancing its PGM portfolio.

NB - I took a position in SBSW a little while ago.

4 - Norilsk Nickel (Nornickel)

Estimated 2023: ~20–23 metric tonnes (aligned with Russia’s 23,000 kg output)

Russia’s largest mining company, based in Moscow, produces platinum as a by-product of nickel and palladium mining on the Taimyr and Kola Peninsulas. Also operates in South Africa and Botswana. World’s largest palladium producer, with platinum as a secondary output.

5 - Northam Platinum Holdings

Estimated 2023: ~14–16 metric tonnes (based on proportional output)

South African company with operations in the Bushveld Complex (Zondereinde, Booysendal mines). Focuses on platinum, palladium, and rhodium, with refining contracted to Germany’s WC Heraeus.

3 Fun Facts about Platinum

Platinum is incredibly dense. One cubic foot weighs about 1,340 pounds, which is much heavier than gold or silver. It is literally a heavyweight champ!

Spanish conquistadors in the 1500s dismissed platinum as “platina” (little silver) and tossed it aside, thinking it was worthless!

The largest platinum nugget ever found, weighing 9.5 kg (21 lbs), was discovered in Russia’s Ural Mountains in the 19th century.

4 Contrarian Investment Cases and Summary

Contrarian Investment Cases

1 - Platinum is undervalued relative to gold and palladium

2 - ESG and green mandates could revive demand via hydrogen economy

3 - South African instability adds a “black swan” supply risk.

4 - It is a very thin market i.e. any major demand shift (e.g. from fuel cells) could significantly spike the price

Summary

Platinum is a very useful element. It has a bright although somewhat undetermined future at the moment. Platinum could also potentially be a very good arbitrage play if the PGR increases/GPR decreases.

A special milestone was reached this week when The Contrarian Capitalist surpassed 2,500 subscribers. This is superb to see and it is great to know that more and more people are getting great value from the podcasts/newsletters and content that is being produced.

As a thank you, I would like to offer you 25% off for life on both monthly and annual subscriptions. Please use the button below and offer valid until Tuesday 24th June 2025.

I anticipated the rise of Platinum two years ago based on the temporary demise of EVs and supply demand imbalance. I owned both Implats(IMPUY) and Zimplats (ZIM.ASX). While the price of physical Platinum was low but steady the stocks perpetually lost value(just look at the price chart over the last 5 years). I started reading the quarterly reports, and it was clear that these operations border on scams, created to benefit: foremost the government, then the executives and especially the employees at the expense of investors on other continents. I strongly suggest avoiding any such operations in South Africa (Sorry to say)!

Great content. Well documented.